Pour réussir

ses études

Pour étudier efficacement, il est important de bien s'organiser. Il est indispensable d'apprendre à partager son temps entre études et loisirs pour maintenir votre bien-être. Découvrez de nouvelles méthodes de révision pour réussir vos examens.

Mémoriser les cours

Les flash-cards

Prise de notes

Le sketchnote

High-tech

Le lapbook

Parler anglais

Apprendre l'anglais facilement

Améliorer votre maîtrise de la langue anglaise peut vous permettre de booster votre carrière, trouver un premier job, ou vous reconvertir dans un nouveau secteur d’activité. La langue de Shakespeare s’impose comme une véritable porte d’entrée vers des postes à l’international. La maîtrise parfaite de l’anglais fait partie des critères indispensables pour occuper des postes dans certaines entreprises. Pour améliorer votre niveau linguistique, vous pouvez faire appel à des formateurs professionnels comme Global Exam dont le programme pédagogique vise à évaluer votre niveau, définir votre objectif et améliorer vos compétences au moyen d’une méthode d’une efficacité éprouvée.

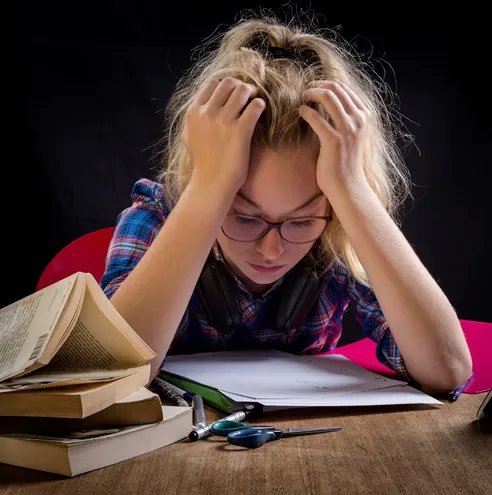

Echec scolaire Soutiens aux élèves en difficulté scolaire

Les élèves en difficulté scolaire peuvent bénéficier de soutien pédagogique pour les aider dans leur apprentissage. Il existe en effet des dispositifs d’accompagnement pour cette catégorie. Le soutien scolaire est également très utile aux jeunes souffrant de dyslexie, dysphasie, dyspraxie et dysgraphie.

Du premier coup

Réussir sa première année

Les étudiants qui souhaitent réussir leur première année devront adopter de meilleures méthodes afin d’aborder des études universitaires dans de bonnes conditions. Le secret de la réussite est basé sur une bonne orientation. Le candidat devra privilégier des études relatives à ses futures ambitions afin de garder intacte sa motivation.

Pour éviter de perdre du temps et de l’argent dans un mauvais choix de filière, il est primordial de bâtir votre projet dès le lycée. De cette manière, vous ne risquez pas d’être découragés, d’abandonner vos études parce que vous ne trouvez pas les débouchés qui vous intéressent pour vous motiver dans vos études.

Examens : Comment réussir ses concours ?

La bonne technique pour réussir votre concours est de ne pas craindre l’échec ni vouloir tout maîtriser. Le secret de la réussite d’un examen consiste à adopter un comportement serein. Songez plutôt à assumer votre engagement, votre ambition, vos compétences. Pensez à moins réviser, mais révisez intelligemment. Pour cela, apprenez à vous faire confiance en réduisant la masse documentaire à réviser, mais en veillant à comprendre plus de renseignements pertinents.

L’auto-évaluation

L’auto-évaluation est une aptitude de réflexion permettant d’évaluer les aspects importants de ses études.

La répétition du travail

Répéter intensivement les exercices permet d’acquérir des automatismes comme une tâche ou une notion.

L'interrogation posée

Le rôle de l’interrogation collaborative est de se poser des questions sur une matière puis essayer d’y répondre.

L’auto-explication

L’auto-explication consiste à s’expliquer à haute voix les solutions à un exercice ou à un problème.

Le coaching

pour étudiant

Un coach accompagne les étudiants en leur proposant un programme personnalisé. Ce pédagogue les aide à mieux se connaître, aborder le marché de l’emploi en toute confiance et être motivés par leurs projets professionnels. L’accompagnateur travaille avec le coaché pour identifier ses ressources internes afin de les motiver dans leurs études.